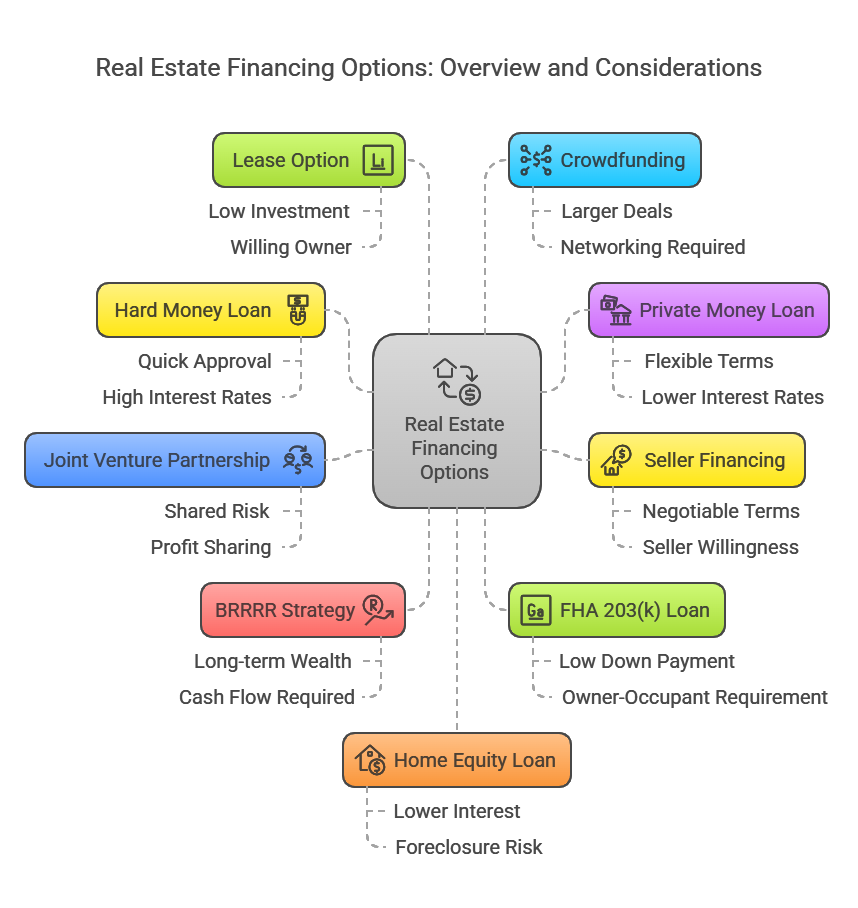

How it Works: Short-term loan from a private lender, secured by the property.

Pros: Quick approval, flexible terms.

Cons: High interest rates, short repayment period.

How it Works: Borrowing from individuals, family, or acquaintances.

Pros: Flexible terms, lower interest rates.

Cons: Requires strong networking.

How it Works: The seller finances the deal, and the buyer makes payments over time.

Pros: No banks, negotiable terms.

Cons: Seller must be willing, possibly higher interest.

How it Works: One partner funds, the other manages.

Pros: Shared risk, no debt.

Cons: Profit sharing, potential disagreements.

How it Works: Rent the property before refinancing to pull out capital.

Pros: Long-term wealth-building.

Cons: Requires cash flow to sustain until refinance.

How it Works: Owner-occupants can finance purchase & renovation with low down payment.

Pros: Low down payment.

Cons: Must live in the property for 12 months.

How it Works: Lease the property with an option to buy after renovations.

Pros: Low upfront investment.

Cons: Requires a willing owner.

How it Works: Pooling funds from multiple investors.

Pros: Access to larger deals.

Cons: Requires strong networking.

How it Works: Using existing property equity to finance the flip.

Pros: Lower interest than hard money.

Cons: Risk of foreclosure.

How it Works: Using business credit for financing.

Pros: Quick access to funds.

Cons: High interest if not paid off quickly.

How it Works: Find a distressed property and fund it with an investor.

Pros: No personal capital needed.

Cons: Requires a strong investor network.

How it Works: Using federal and state tax credits for historic properties.

Pros: Large renovation cost savings.

Cons: Must follow strict renovation guidelines.